A Strong Mandate, A Narrow Window

Bangladesh is not heading for a crisis, but it faces notable constraints. Inflation remains high but not hyperinflationary. Debt levels are manageable but not insignificant. Institutional guarantees of electoral reform implementation will determine whether this change in government will be long-lasting.

The incoming government faces many constraints as it takes office this weekend. Its inherited toolkit is more of a narrow corridor than a blank canvas. The agenda is more difficult to fulfill than summarize. The most pressing issues are not only stabilizing the economy but also simultaneously reducing street violence and restoring institutional credibility.

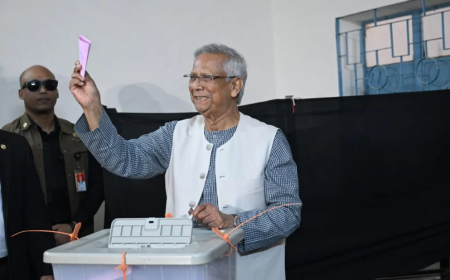

Morning in Bangladesh

The new prime minister’s ministers were sworn in, and the Cabinet is ready for its group photo. While the ink dries, real-world pressures have already started to grow. Rice prices. Fuel bills. Unanswered applications for new jobs. Letters of credit are stuck in red tape.

As of January, year-on-year inflation stood at 8.58%. Growth has slowed; official figures show that GDP increased by 3.7% in FY25, with IMF forecasts suggesting a modest recovery to around 5% if reforms are continued. Official unemployment figures are low, but graduate unemployment is closer to 13-14%, and youth unemployment remains persistently in double digits.

Bangladesh Bank reports approximately $29.5 billion in foreign exchange reserves according to IMF standards and about $34 billion on a gross basis. This matters because the size of buffers that are accessible to markets influences markets, not just headline figures.

The February 12 election gave the BNP a clear mandate in parliament. But the economy -- in fact, the street -- has yet to give it a honeymoon.

Stability, not Stimulus

The initial challenge is figuring out how to prioritize reforms. Voters want relief, while businesses need clear rules to follow. However, limited fiscal space means there will be little room for generosity or policy swings.

Fortunately, the macro-economic outlook is not bleak. Bangladesh exported $48.3 billion worth of goods in FY2024-25, an increase of 8.6% from the previous year. Remittance flows have been strong lately, exceeding $3 billion in several months this year. Public debt levels remain comfortably in the low-40% of GDP range and are easily sustainable by historical standards. However, there are some specific vulnerabilities.

The budget deficit is expected to reach about 4.3% of GDP in FY26, with total revenue and grants around 8% of GDP -- one of the lowest revenue shares in the region. The banking sector is under noticeable stress, and although estimates of non-performing loan ratios differ, most analysts are worried about the quality of the underlying assets. Inflation remains persistent.

Taken together, these risks could come to a head in three ways:

- A loss of confidence in the banking sector leads to expensive government intervention

- A second wave of inflation driven by energy prices or currency exchange adjustments

- Policy reversals scare investors, especially those related to FX and imports

The best way to build early confidence is through clear yet technical measures: Release a transparent 90-day stabilization plan; conduct credible asset-quality reviews of major banks; selectively expand social safety nets; and avoid price controls. Stability isn't flashy politics. But without it, growth promises are just theoretical.

Balancing the Books and the Boulevard

The incoming administration will need to balance its approach across three pressure spheres:

First, within the coalition, a comfortable majority is far from a landslide. Ambitions and egos regarding portfolios, patronage, and local power will be strong. Ministerial appointments, starting with finance, home, and energy, will signal the credibility of reform intentions.

Second, regarding its stance on Islamist pressure, repression will only lead to increased radicalization. Doing nothing will allow further extremism. Maintaining consistent, strong, neutral, and predictable rule-of-law standards is the most sustainable way forward.

Third, regarding the youth voice. Analysts may debate the precise makeup of currents within the July 36 movement; some view certain elements as extremists, while others acknowledge genuine frustration behind the diverse calls for reform.

Broad narratives and labels will only worsen divisions. The government should establish clear civic expectations (no violence or coercion) and encourage constructive dialogue on jobs and reform. This strategy can transform street unrest into productive pressure.

A subtle underlying message is any gesture towards the Awami League. Reconciliation will eventually be necessary for legitimacy.

However, witch hunts would only deepen polarization. The only way to achieve balance is through meaningful institutional investigation processes, not political ones.

Bangladesh demonstrated it could progress beyond its 1991 stabilization by adhering to strong rules from both sides. The lesson from 2007– 08 and the caretaker government that followed remains just as important: Technocratic solutions without political stability are only temporary.

Institutions serve as the foundation upon which political events are built.

Reform Without Drama

Any government says it will crack down on corruption. Few alter the underlying incentives. The IMF concluded in its latest assessment that governance issues and banking-sector reforms are essential for macroeconomic stability. The credible reform agenda will be a quiet process.

Transparency in public procurement can be easily enhanced. Governments should be mandated to publish tender details, including official evaluation reports such as contract amounts and changes, in machine-readable formats. Abuse happens when officials make minor technical adjustments or post-award modifications without proper oversight. Transparency helps prevent favoritism.

Revealing the ultimate ownership of major public contractors and large bank borrowers would also enhance accountability. Complex structures and related-party transactions often conceal the true beneficiaries, enabling corruption. Disclosing true ownership helps to lower these risks.

Beyond these immediate steps, Bangladesh Bank must also strengthen its supervisory independence. Implementing risk-based supervision and imposing stricter limits on related-party lending are not ideological goals; they are vital for banking stability.

Well-functioning financial courts with specialized expertise and clear timelines could help eliminate the culture of strategic default. Greater stability and performance agreements for other key technical ministries, from NBR to energy regulators, would support institutional reforms and prevent arbitrary rotations.

The aim should be predictability. Businesses can plan around strict rules but not whims.

India, China, and the United States.

The government should prioritize economic issues with India. Trade facilitation, border management, transit connectivity, and norm-sharing protocols all need the attention of dedicated working groups as soon as possible.

Bangladesh is an important neighbor and market for India, as well as a transit partner. Quiet progress will last longer than grand announcements. China emphasizes discipline.

Bangladesh is also vulnerable to projects that fail basic creditworthiness checks. Public debt levels remain manageable; however, contingent liabilities from state-owned enterprises and banks could rise quickly if due diligence is not observed. Continue making progress where reforms succeed; be cautious and transparent where they face challenges.

The recent agreement with the United States on a reciprocal trade framework is one of the most politically sensitive issues the new government will inherit from the interim administration. Opposition parties, civil society, and professionals have raised concerns about three main points: The affordability of long-term commitments, the legitimacy of the mandate to sign, and the fiscal cost of implementation.

These criticisms are valid. However, instead of pursuing outright repeal, the new government can commit to a parliamentary review of the deal, renegotiate the most significant fiscal risks, and implement phased measures where feasible.

Transparency will reduce short-term political risks while protecting long-term export competitiveness. Risk weights: India -- medium risk, high upside. China -- medium risk if credit disciplines are maintained. The US deal carries high short-term political risk and moderate economic risk.

Bangladesh’s foreign policy decisions now have immediate economic, fiscal, and inflation impacts. They are just as much about economics as diplomacy.

100 Days to Repair

Actions will speak louder than populist promises as we enter the next 100 days. Here are five key areas to monitor in the first month:

A single, publicly announced FX reform plan; visible early actions to improve the banking sector; credible steps on monetary policy and fuel prices to keep inflation expectations steady; transparent energy tariffs where subsidies are maintained; predictable tax administration; early implementation of procurement transparency pilots; stability and capacity in ports and industrial zones; clarity on new labor law commitments and regulatory compliance expectations; and proportionate responses to street protests.

We anticipate publishing a 90-day economic stabilization plan, initiating reviews of bank assets, announcing targeted food market interventions, and securing parliamentary approval for major external agreements within the first 30 days.

Foreign exchange unification, rules-based governance mechanisms for banks, and a tax administration charter on predictable enforcement would serve as positive structural indicators within 100 days.

Within a year, credible increases in revenue mobilization, energy-sector pricing reform, judicial enforcement of financial crime penalties, and institutional guarantees of electoral reform implementation will determine whether this change in government will be long-lasting.

Opportunity and Constraint

On Wednesday, Bangladesh turned the page to a new government. Economically, the clock started when the results were announced.

Bangladesh is not heading for a crisis, but it faces notable constraints. Inflation remains high but not hyperinflationary. Debt levels are manageable but not insignificant. FX reserves are sufficient but not plentiful.

The political mandate stays popular but is not guaranteed to persist. Discipline will be the new administration’s greatest ally. Populism, however, will be its quickest adversary.

What's Your Reaction?