Emerging Markets Monitor

Emerging markets ETFs’ rally has been somewhat of a surprise: They own shares of companies in less-developed nations. For decades, these stocks took a backseat with investors who would rather pay up for shares of giant companies in developed nations like the U.S. But now, many factors are working in emerging markets’ favor.

Emerging Markets Soar Again

“It’s been a long time since risky emerging markets stocks paid off for investors. But they’re taking off in a big way again now.”

“Shares of the 10 largest emerging markets ETFs, including iShares Core MSCI Emerging Markets (IEMG), Vanguard FTSE Emerging Markets (VWO) and iShares MSCI Emerging Markets (EEM), soared 10.3% this year, says data from ETFDB and S&P Global Market Intelligence.”

“That’s a stunning showing, topping the S&P 500’s year-to-date gain of just 1.6% by a mile.”

“Emerging markets ETFs’ rally has been somewhat of a surprise: They own shares of companies in less-developed nations. For decades, these stocks took a backseat with investors who would rather pay up for shares of giant companies in developed nations like the U.S. But now, many factors are working in emerging markets’ favor.”

“‘Emerging markets are finally seeing fresh tailwinds in the form of cheaper valuations, a weakening dollar and a global AI boom,’ said Kirsten Chang of TMX Vetta Fi. ‘On a total return basis, (emerging markets) were the single best regional index in 2025 and are once again stealing the show in 2026.’”

“Thinking the weak dollar will help companies overseas, investors poured money into international ETFs in January. And emerging markets took the biggest piece of this surge, Chang says.”

“And it’s easy to see why. U.S. markets continue to be heavily weighted toward just a handful of giant tech companies. Emerging markets offer diversification. They also buffer investors from the plunging U.S. dollar. Perhaps best of all, they ‘remain relatively cheap at roughly 15 times forward 2026 earnings compared to the S&P 500, which is still trading at a premium,’ Chang said.” Matt Krantz reports.

The US Is Sending Its Largest Warship to the Middle East: A Message to Iran

“The Pentagon is sending the Navy’s largest and most advanced aircraft carrier to the Middle East, as the U.S. steps up plans for a potential attack on Iran, two U.S. officials said.”

“The USS Gerald R. Ford carrier strike group is deploying to the region after spending several months in the Caribbean and Mediterranean. It will be joining the aircraft carrier USS Abraham Lincoln and nine other warships already operating in the Middle East.”

“The move comes as President Trump ramps up pressure on Iran to make concessions over its nuclear program. Officials from the U.S. and Iran held a first round of talks last week, and Trump has indicated that he is open to making a deal with Tehran to head off military action.”

“‘They want to make a deal, as they should want to make a deal,’ Trump told reporters last week. ‘They know the consequences if they don’t. If they don’t make a deal, the consequences are very steep. So we’ll see what happens.’”

“…The Ford will bring dozens more jet fighters and surveillance aircraft to the region and enable commanders to carry out airstrikes at a higher rate. In addition to moving warships, the U.S. has also sent dozens of aircraft and several air-defense systems to bases across the Middle East.” Shelby Holliday reports.

Emerging Economies Shine Despite U.S Volatility

“Despite the risks of Donald Trump’s aggressive protectionist agenda, the mood among policymakers and central bankers at the Conference for Emerging Market Economies in AlUla, Saudi Arabia, this week was cautiously upbeat. Assets across the ragtag grouping of economies have been on a tear. Last year, benchmark equity indices in countries including South Korea, Poland and Vietnam more than doubled the S&P 500’s 16 per cent gain.”

“Returns on local-currency bonds and sovereign credit outpaced developed markets too. The rally has rolled on into 2026. A weak dollar, in part a byproduct of the US president’s capricious approach to policymaking, has helped. International investments now look more attractive, and developing economies’ dollar debts and import costs have fallen.”

“In other words, as America has started to display traits investors often associate with risky emerging markets, actual EMs have prospered….many emerging economies are no longer peripheral players in global trade and manufacturing. The 10 emerging-market members of the G20 -- including China, India and Brazil -- now account for more than half of global GDP growth. Export powerhouses such as South Korea, Vietnam and Taiwan have benefited from the AI boom, supplying chips and high-tech components to US hyperscalers.”

“Many emerging Asian economies have embedded themselves more deeply in non-US supply chains too. Rapid urbanization, rising consumer classes and large labour pools mean investors are beginning to view emerging market businesses as more than just a portfolio hedge. Valuations reinforce the case. Emerging market equities remain attractively priced relative to developed peers after being unloved for so long.”

The FT Editorial Board writes.

AI Fears Wipe Out $50 Billion in Indian Stocks in February

“Indian IT shares logged their worst week in more than 10 months on Friday, extending a rout driven by fears of disruption from artificial intelligence tools that wiped about $50 billion off the sector’s market capitalization so far in February.”

“The launch of a tool by tech startup Anthropic last month triggered a global tech sell-off and intensified concerns that rapid adoption of generative AI could upend India’s $283 billion IT services industry. For the week, the Nifty IT slid 8.2 per cent, its steepest drop since April 2025.”

“Analysts at J.P. Morgan flagged investor concerns that India’s IT firms could miss growth targets as AI pushes clients to reallocate spending….The losses on Friday were led by a 2.1 per cent drop in industry leader Tata Consultancy Services. Infosys declined 1.2 per cent and HCLTech dropped 1.4 per cent.”

“Friday’s mid-session recovery was largely due to investors ‘buying the dip’ on attractive valuations, Centrum Broking’s Piyush Pandey said. ‘Investors have largely over-reacted to the threat posed by these AI tools. It is important to note that IT companies remain relevant even in the age of AI, albeit with a leaner headcount.’”

“JP Morgan noted…’IT Services companies remain the plumbers in the tech world, and if enterprise software/SaaS is rewritten on a bespoke basis by agents - it will need significant services plumbing to work in enterprise context and minimize AI slop.’” Channel News Asia reports.

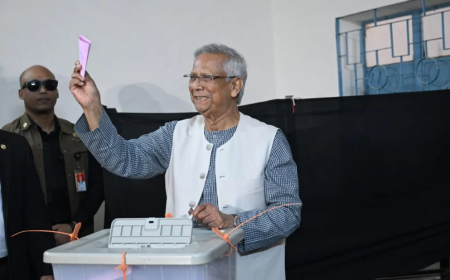

Bangladesh Nationalist Party Wins Election

“The Bangladesh Nationalist Party secured a decisive victory in the country’s first election since a 2024 youth-led uprising ended 15 years of increasingly authoritarian rule, clearing the way for its once-exiled leader to take power.”

“The BNP crossed the threshold for a two-thirds majority in parliament in Thursday’s election, according to the Bangladesh Election Commission. This would set up Tarique Rahman -- who ended a 17-year exile in London and returned to Bangladesh in December -- to try and rebuild the developing nation’s garment-reliant economy.”

“A youth-led movement two years ago toppled former Prime Minister Sheikh Hasina in a violent street revolution fueled by grievances over joblessness and lack of economic opportunities. The election puts the BNP, a mainstream party that advocates social welfare and Islamic values, on the cusp of retaking power in the world’s eighth-most populous country for the first time in two decades.”

“The incoming administration will inherit an economy battered by inflation, a banking sector riddled with non-performing loans and corruption ranked as among the worst in the world. It will also look to balance ties with India and China at a moment when New Delhi is increasingly wary of Beijing’s expanding footprint along the Bay of Bengal, and Washington is recalibrating its South Asia strategy.”

“…Ruchir Desai, fund manager at Asia Frontier Capital Ltd., described the BNP victory as a positive development for Bangladesh and investor sentiment, noting that Bangladesh stocks rallied sharply in the weeks leading to the vote. ‘This majority win is what was needed as a strong catalyst to revive the economy and stock market,’ Desai said. ‘I expect further double digits gains because of this big mandate for the BNP.’”

“Rahman, 60, is the eldest son of former Prime Minister Khaleda Zia and former President Ziaur Rahman, the founder of the BNP who was assassinated in 1981. During the election campaign, Rahman has sought to cast the BNP as a centrist bulwark against what it describes as the radical agenda of its rivals.”

“The BNP overcame an unusual alliance of Islamist parties and student leaders to secure victory. The Bangladesh Election Commission reported Friday afternoon that the BNP won at least 201 out of 300 seats in parliament, with vote-counting still underway. The opposition bloc led by the Islamist party Jamaat-e-Islami and its allies won 76.”

“Rahman is set to take over from the interim government led by Nobel laureate Muhammad Yunus, which has governed Bangladesh for the year and a half since Hasina’s ouster. Yunus is expected to begin the formal transition of power within a week.”

“…Investors and multilateral lenders will watch whether Rahman can deliver institutional reforms while navigating ties with India and China and managing a $5.5 billion loan program with the International Monetary Fund.” Arun Devnath reports.

Saudi Replaces Key Minister in Bid to Attract More Foreign Investment

“Saudi Arabia today replaced Investment Minister Khalid Al-Falih -- one of the government’s longest-serving and most internationally well-known figures -- with a senior executive from the kingdom’s sovereign wealth fund, part of a wider reshuffle as the kingdom scraps investment projects and steps up efforts to lure foreign cash.”

“One of the more outspoken members of the Saudi government, Al-Falih had this week questioned the feasibility of some projects, like a 170-km (105-mile) mirrored skyscraper called The Line that is being scaled back. He was also not afraid to use a stick to bring investors into the country, telling foreign firms they would lose out on government contracts unless they put regional HQs in Riyadh. Al-Falih will retain ministerial rank, making it unclear if he’s being pushed aside or given other responsibilities.”

“Al-Falih’s replacement is Fahad Al-Saif, a highly experienced banker who is respected in the global finance community. Al-Saif essentially built the kingdom’s borrowing capabilities and has traveled the world to drum up interest in Saudi Arabia’s first bond sales.”

“…His next task may prove harder. Getting bond investors to buy highly rated Saudi debt is much easier than bringing in the kind of long-term foreign direct investment the kingdom needs. Al-Falih set out a target of getting $100 billion a year of foreign investment by 2030, but got less than halfway there.” Mathew Martin reports.

Major Kenya IPO Signals Full Steam Ahead on Privatization

“The planned initial public offering (IPO) of the Kenya Pipeline Company (KPC) is one of the most ambitious privatizations Kenya has attempted in decades. The government is seeking to raise 106.3bn shillings ($825m) through the sale of 11.8bn shares at 9 shillings ($0.07) each, a transaction that will reduce state ownership in the parastatal to 35% and hand private investors a 65% stake.”

“…KPC runs Kenya’s midstream petroleum infrastructure, operating an extensive network of pipelines and depots that move refined products from the Port of Mombasa to demand centres nationwide. As an absolute monopoly, the firm has consistently delivered strong financial results and regularly pays hefty dividends to the state.”

“..Kenya has not witnessed a privatization transaction this consequential -- in terms of deal size or the strategic nature of the underlying asset and business -- since Safaricom’s 2008 IPO during former President Mwai Kibaki’s tenure. His administration oversaw the sale of shares in several state-owned firms such as Mumias Sugar, Kenya Reinsurance and electricity producer Kengen. His successor as president, Uhuru Kenyatta, did not privatize any parastatal.”

“On top of the KPC IPO, Kenya’s government is set to trim its holdings in Safaricom after inking a deal with Vodacom Group to sell it a portion of its shareholding. The South African telco operator -- which is 65.1% owned by UK’s Vodafone -- agreed to buy 15% of Safaricom from the Kenyan government, along with an additional 5% stake from its parent Vodafone in a deal valued at $2.1bn. Once complete, Vodacom’s overall holding in Safaricom will increase to 55%, leaving the Kenyan government with 20% and public investors with 25%.” Lennox Yieke reports.

What's Your Reaction?