Biman's Crossroads: A Billion-Dollar Gambit in the Shadow of Giants

The message for Bangladesh's policy-makers is clear: ground this decision in data, not delusions of grandeur. Commission and publish an independent, peer-reviewed fleet plan.

The view from the cockpit of a Biman Bangladesh Airlines aircraft on final approach to Dhaka is a panorama of potent symbolism. Below, the serpentine Buriganga River threads through a metropolis pulsing with the energy of a nation on the rise. For the pilots, this vista is a daily reminder of their mission: to connect this vibrant growth to the world.

But today, a different kind of landscape dominates the strategic planning rooms of the airline -- a high-stakes chessboard where two global aviation titans, Boeing and Airbus, are locked in a battle for a multi-billion dollar prize. The decision Biman makes will either catapult Bangladesh into a new era of global connectivity or become an anchor of debt and inefficiency for a generation.

The Allure of the Jumbos: Prestige Versus Prudence

The narrative is seductive. A proud nation, having achieved remarkable economic strides, deserves a national carrier adorned with the latest, most efficient long-haul aircraft. The government’s Vision 2041 and the anticipated graduation from Least Developed Country status demand a symbolic fleet. Reports swirl of a requirement for a dozen or more new wide-body jets, a mix of Boeing 787 Dreamliners and Airbus A350s. On the surface, it’s a story of progress. But delve into the cold, hard calculus of aviation economics, and this narrative begins to show cracks.

The fundamental question remains unanswered: where is the transparent, publicly-available business case? A prudent fleet expansion is not a shopping spree; it is a surgical acquisition of capability. It must be predicated on a rigorous analysis of future traffic.

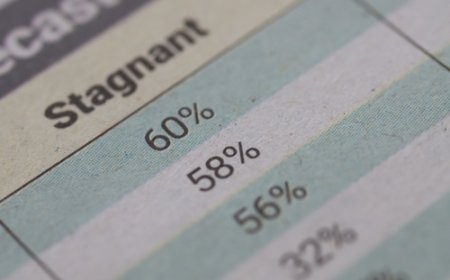

The International Air Transport Association (IATA) forecasts robust global air travel growth, but this is an average, not a guarantee for a specific carrier.

Biman’s own load factors tell a more nuanced story. While the airline has seen recovery post-pandemic, its international routes have historically struggled with consistent, year-round profitability outside of key diaspora corridors like the Dhaka-London route.

The ghost of over-ambition haunts the industry. Consider the cautionary tale of Air India, which, under state ownership, placed a massive 111-aircraft order mix from both Boeing and Airbus only after a years-long process of restructuring, route analysis, and eventual privatization to infuse commercial discipline.

Biman’s plan, as reported, risks repeating the sins of other state-owned carriers: purchasing capacity for prestige rather than proven passenger demand. The result is underutilized assets -- a $300 million aircraft sitting idle on the tarmac is not a symbol of pride, but a monument to financial folly, its debt servicing clock ticking relentlessly.

The Spectre of a Split Fleet: An Engineering and Economic Nightmare

Perhaps the most glaring red flag in this entire saga is the proposition of a split long-haul fleet. In the rarefied world of airline operations, this isn't a strategy; it's self-sabotage. Fleet commonality is not a mere buzzword; it is the holy grail of cost containment.

Every time an airline introduces a new aircraft type from a different manufacturer, it incurs a cost penalty that runs into tens of millions of dollars annually.

Imagine the scene at Shahjalal International Airport. In one hangar, a team of engineers, certified and trained exclusively on Boeing’s complex systems, tends to a 787. Their tools, their spare parts inventory, they're very muscle memory are all Boeing-specific.

Across the apron, in another hangar, a separate team, with entirely different training and certification from Airbus, works on an A350. The two teams are not interchangeable. This duplication is a relentless drain on resources.

The International Air Transport Association has long highlighted that maintenance, repair, and overhaul (MRO) costs can account for 10-20% of an airline’s total operating expenses, a figure that balloons without commonality.

The chaos extends to the flight deck. A pilot rated to fly a Boeing cannot simply slide into the cockpit of an Airbus. The two manufacturers have fundamentally different philosophies -- Boeing’s yoke versus Airbus’s sidestick, each with unique software and handling characteristics.

Type-rating a single pilot can cost over $50,000. To staff two separate long-haul fleets, Biman would need to maintain two entire, and expensive, pilot pools, with dedicated simulator time and recurrent training.

This logistical labyrinth is why successful, profit-focused airlines like Emirates have built their empires largely around a single long-haul family -- first the Boeing 777, and now the Airbus A380 and A350 -- to achieve staggering economies of scale.

The Shadow of Geo-politics and the Public Interest

In any major state-owned enterprise, large procurement decisions are rarely purely commercial. The battle between Boeing and Airbus is as much about geo-politics as it is about aerodynamics. A multi-billion dollar order is a powerful tool of statecraft, a lever to strengthen ties with Washington or Brussels.

The tough battle reported in the media is likely being waged not just in Biman's boardroom, but in the corridors of power in Dhaka, with diplomats from both sides making their cases.

This is where the narrative must return to the public interest. The Bangladeshi people, who ultimately underwrite the financial risk of a state-owned enterprise, have a right to transparency.

Was a formal Request for Proposal (RFP) issued, with clear, technical and economic evaluation criteria? Have independent aviation consultants been engaged to model the financial viability of this expansion? The silence is deafening.

The alternative path is one of disciplined, phased growth. Instead of a massive, simultaneous order, a strategic plan could involve a smaller, initial commitment to a single aircraft type to replace aging aircrafts and expand capacity on proven routes.

The success of this initial phase would then finance and justify subsequent orders. This is the method employed by astute carriers like Delta Air Lines, which meticulously manages one of the world's largest fleets through a constant cycle of data-driven retirement and acquisition.

A Clear Call for the Skies

The vision of a modern, world-class Biman is not the problem; it is the destination. The peril lies in the chosen flight path. The current trajectory, shrouded in opacity and seemingly ignoring foundational principles of aviation economics, risks turbulence that the airline and the nation can ill afford.

The message for Bangladesh's policymakers is clear: ground this decision in data, not delusions of grandeur. Commission and publish an independent, peer-reviewed fleet plan. Prioritize operational efficiency through fleet commonality. And most importantly, treat this not as a diplomatic trophy, but as a sovereign investment in the nation’s economic future.

The view from the cockpit is indeed a symbol of potential, but it is the soundness of the decisions made on the ground that will determine whether Biman soars as a beacon of national pride, or remains tethered by the weight of avoidable debt.

Zakir Kibria is a Bangladeshi writer, policy analyst and entrepreneur based in Kathmandu, Nepal. His email address is [email protected].

What's Your Reaction?